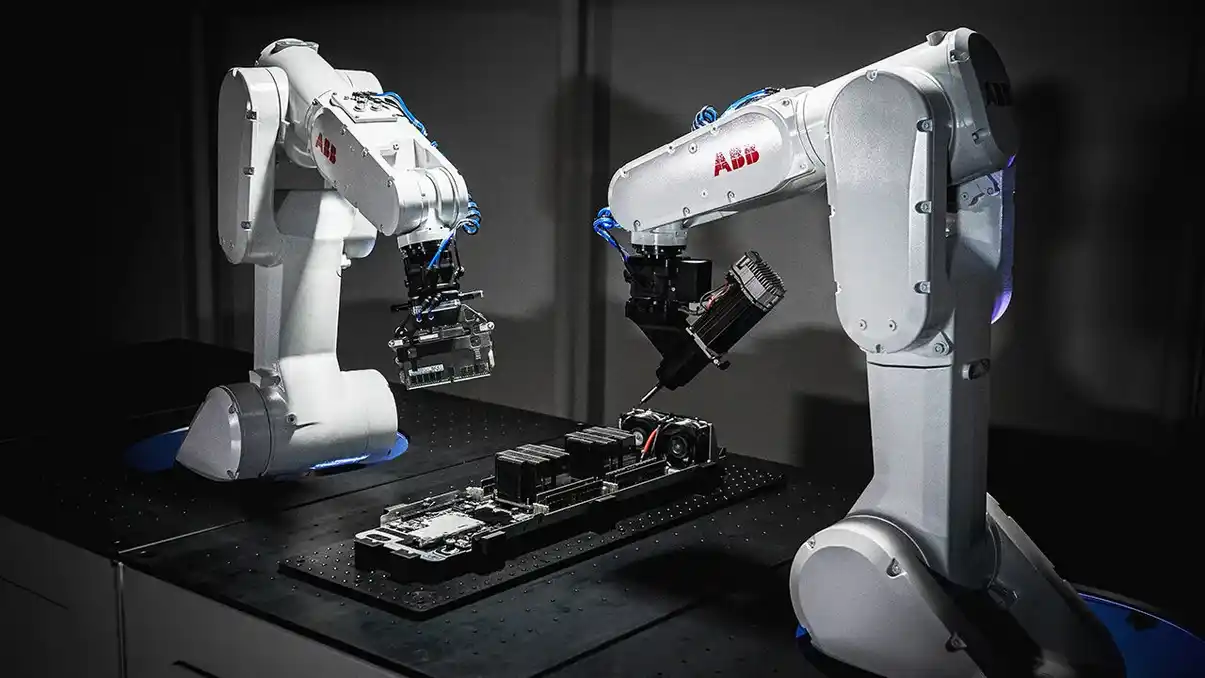

Proposed deal aims to bolster chipmaker’s Ohio factory plans, signaling strategic support

Intel stock surged over 7% on Thursday following reports that the Trump administration is exploring a financial stake in the semiconductor giant.

The potential investment would support Intel’s ambitious plans to develop a major manufacturing hub in Ohio, according to Bloomberg, though the scale of the stake remains undisclosed.

Government Involvement / Strategic Support for Ohio Hub

The proposed deal, reported by Bloomberg, focuses on bolstering Intel’s Ohio factory, which was envisioned as the world’s largest chip manufacturing facility.

The project has faced repeated delays, but a US government stake could provide critical funding and stability.

White House spokesperson Kush Desai cautioned that “talk of hypothetical investments should be treated as speculative until officially confirmed by the administration.”

You May Also Like:

Fortnite Players Can Claim Refunds by September 17, 2025: Here’s How

iPhone Users Face 30-Day Deadline to Update to iOS 18.2 or Risk Losing Features

Political Context

The discussions follow a recent meeting between Intel CEO Lip-Bu Tan and President Donald Trump, who previously labeled Tan “highly conflicted” due to his past business ties to China.

Trump’s social media post last week called for Tan’s resignation, citing alleged investments in firms linked to the Chinese military.

Intel’s spokesperson, when contacted by the BBC, declined to comment on the talks but affirmed the company’s commitment to “supporting President Trump’s vision for strengthening US technology and manufacturing dominance.”

Industry Challenges Falling Behind in AI

Intel, once a titan in the chip industry, has struggled to keep pace in the artificial intelligence (AI) race, where rival Nvidia has taken a commanding lead.

The company’s market value has plummeted from its 2020 peak to $104 billion (£77bn), a decline of over 50%. “

This potential government backing could be a game-changer for Intel, providing both capital and strategic alignment,” said David Nicholson, a tech analyst at The Futurum Group.

Competitive Landscape

The deal underscores a growing trend of government-private sector collaboration in the US, mirroring practices in countries like China.

This follows recent moves by chipmakers Nvidia and AMD, who agreed to pay the US government 15% of their Chinese revenues, reflecting the Trump administration’s hands-on approach to tech policy. “

Some may view this as unfair favoritism toward Intel, but many see it as vital for US technological leadership,” Nicholson told the BBC.

Strategic Importance Ohio Factory’s Role

Intel’s Ohio plant is central to its turnaround strategy under CEO Lip-Bu Tan, who assumed leadership in March 2025. Tan, a seasoned American venture capitalist, has prioritized financial restructuring and catching up in the AI chip market.

The Ohio facility aims to position Intel as a domestic leader in high-end semiconductor production, reducing reliance on foreign giants like TSMC and Samsung.

National Security Implications

Supporting Intel could be a “unique case” due to its critical role in US chipmaking, according to tech analyst Austin Lyons. “Intel is America’s strongest contender against global competitors,” he said. A government stake could ensure the US maintains a competitive edge in semiconductors, vital for both economic and national security interests.

Posts on X reflect mixed sentiments, with some praising the strategic move and others questioning government intervention in private enterprise.

This article is based on a report by Osmond Chia, published by BBC News on August 14, 2025. Additional context was drawn from posts on X discussing Intel’s potential government stake and its implications for the chip industry.