White House explores 15% export tax as part of broader push to control AI technology exports

Key Points

- The Trump administration is still finalizing the legal framework for a 15% export tax on Nvidia and AMD’s China-specific AI chip sales.

- The policy, potentially expanding to other firms, aims to leverage US export licenses for revenue.

- Legal experts warn that existing trade laws may complicate the implementation of such fees.

What just happened?

Last night, news emerged of a “trade deal” that has never happened before.

Nvidia and AMD agreed with Trump to provide the US with 15% of REVENUE from chip sales in China to remove export controls.

Corporations are panicking. Here’s why.

(a thread) pic.twitter.com/HKTNbwMPIl

— The Kobeissi Letter (@KobeissiLetter) August 11, 2025

The Trump administration is navigating complex legal terrain to implement a 15% export tax on Nvidia and Advanced Micro Devices (AMD) for their AI chip sales to China, with potential plans to extend similar deals to other companies, White House spokesperson Karoline Leavitt announced on Tuesday, August 12, 2025.

Policy Details Export Tax Framework

President Donald Trump confirmed on Monday that he negotiated an agreement with Nvidia, allowing the US government to approve export licenses for the China-specific H20 AI chip in exchange for 15% of the revenue.

AMD also secured licenses under similar terms, with a portion of its China sales contributing to the US treasury. “I told them, ‘If I’m granting you a release, I want a share for our country,’” Trump said, emphasizing the financial benefit to the US.

Leavitt noted that the policy currently applies to Nvidia and AMD but could expand to other firms in the future.

Legal Complexities

The mechanics and legality of the export tax are still under review by the Department of Commerce, Leavitt told reporters. “The details are being ironed out, and the Commerce Department will provide further clarity on implementation,” she said.

Trade lawyers and experts caution that existing US laws regulating export license fees could pose significant challenges, potentially delaying or altering the policy’s rollout. The Commerce Department did not immediately respond to requests for comment.

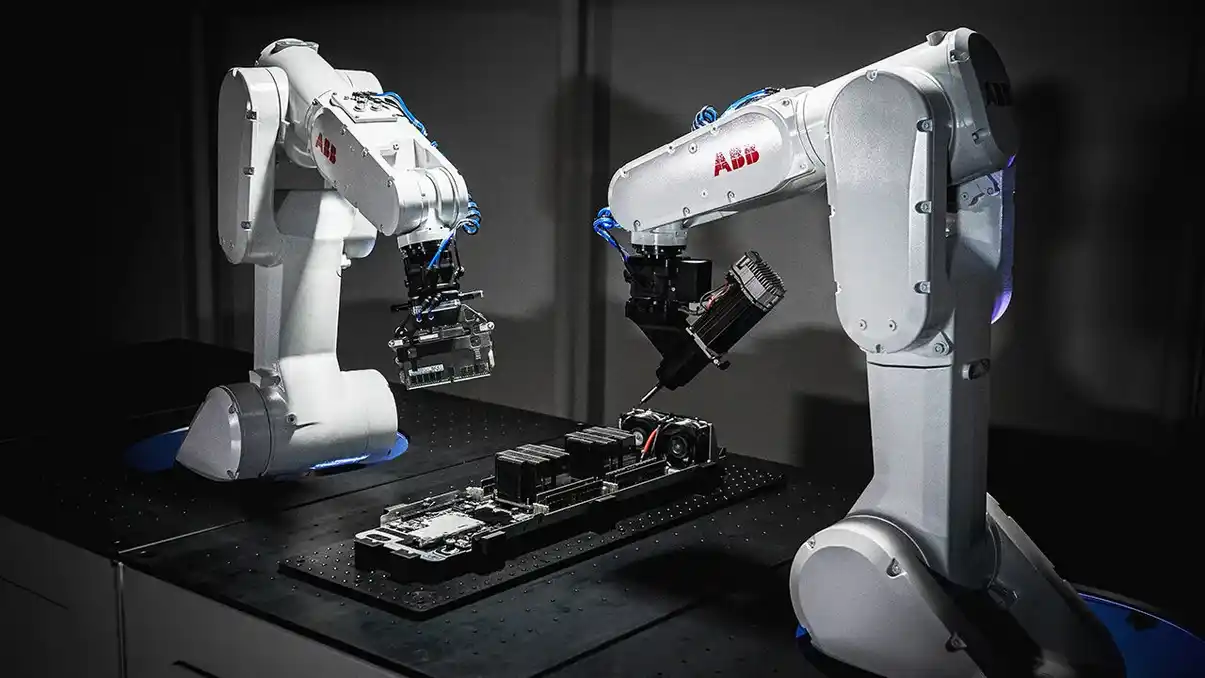

Industry Context Nvidia’s H20 Chip

Nvidia’s H20 chip, designed specifically for the Chinese market, is a scaled-down version of its H100 and H200 chips to comply with US export controls introduced by the Biden administration in 2023.

The chip’s export required a license starting in April 2025, following Trump’s approval signaled in July after Nvidia CEO Jensen Huang’s White House visit. Nvidia stated, “We adhere to US government rules for global market participation,” underscoring its compliance with the evolving regulatory landscape.

Strategic Implications

The US regulates AI chips due to national security concerns, citing their potential use by the Chinese government or military to advance AI capabilities.

Recent reports indicate China is discouraging local firms from using Nvidia’s H20 chips for government or security-related projects, per Bloomberg.

This deal reflects a broader US strategy to maintain technological dominance while extracting economic benefits, a trend echoed in discussions about Intel’s potential government stake ().

You May Also Like to read:

It shocked the US market but has China’s DeepSeek changed AI?

Elon Musk Targets Apple with Antitrust Lawsuit Threat Over App Store Bias

Trump calls for Intel boss Lip-Bu Tan to resign over alleged China ties

Market and Policy Reactions Investor and Analyst Response

The announcement has sparked mixed reactions. Posts on X highlight investor uncertainty about the policy’s impact on Nvidia and AMD’s stock performance, with some praising the revenue-sharing model and others questioning its legality (,,).

“This is a bold move, but the legal foundation is shaky,” said trade analyst Laura Kim, noting potential conflicts with international trade agreements.

Broader Trade Strategy

The chip deal aligns with Trump’s aggressive trade policies, including recent tariffs on India () and a US-China trade agreement reducing tariffs by 115% ().

The administration’s hands-on approach, evident in its Smithsonian oversight () and Apple investment talks (), signals a shift toward deeper government involvement in private enterprise, raising debates about fairness and strategic necessity.

This article is based on a report by Kif Leswing, published by CNBC on August 12, 2025. Additional context was drawn from posts on X discussing Nvidia, AMD, and US trade policies.